RAP-EQ™

Analytics designed to optimise global (macro) equities trading, equity hedging and equity market making, providing directional (downwards) market moving insights.

RAP-EQ™ is our directional equity forecasting analytics providing advance warning of downside market movements. Based on the flagship ALDX PI™ analytics, RAP-EQ™ incorporates directional (downward) market forecasting capabilities based on our latest adaptive clustering technology.

Applications and use cases:

- TradinG

- Hedging decisions

- Market making applications

Key Metrics:

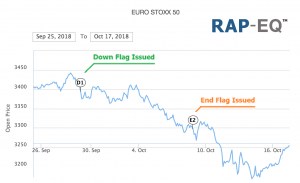

- End of trading day insight Flags providing start and end of downward market movement periods

- Coverage: global (macro) equities indices and single stocks

- Typically between 15 and 25 Flags per instrument per year

- Distribution via email alerts, web interface and API

Delivery channels

Web Interface

Always connected, universal access.

Email Alerts

Reliable, time stamped, authenticated, digitally signed.

API's

Easy integration into any platform or any front end.

Figure 1: example of RAP-EQ™ down Flag followed by end Flag

Get in touch with us

We are happy to have a 15 minutes exploratory call to discuss your actual requirements and explore the best way to augment your investment and trading strategy through our analytics.